|

|

|

|||||

|

|

|||||||

|

|||||||

|

|

|||||||

![]()

![]()

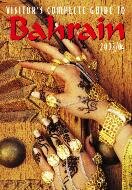

With Bahrain gaining in popularity as a tourist destination, many tour operators have begun offering package deals with charter flights and hotel stay. Check with your travel agent, there are some real bargains to be had!

The Arab Banking Corporation building in Manama

Bahrain is the centre of

Gulf banking universe

By Paul Papadopoulos

Visitors to Bahrain can hardly fail to notice the numerous bank buildings in Manama, notably the steel and glass skyscraper of National Bank of Bahrain, and the individualistic headquarters of Arab Banking Corporation, Gulf International Bank, and the Bahrain Monetary Authority edifice among others that are mirrored in the turquoise Gulf waters that lap Manama's shores. The bank buildings are particularly impressive at night when they are illuminated.

However, the 175 or so financial institutions active in Manama are not simply showcases. Bahrainis are naturally proud of them for the financial sector is of great importance to Bahrain in furthering the countrys continuing goal of achieving economic diversity.

Finance accounts for a significant proportion of Bahrains economy and employs several thousand Bahrainis. Moreover, in recent years Bahrain has been further expanding and diversifying Manamas role as a regional and international financial centre.

The Bahrain Monetary Agency (BMA), which acts both as Bahrains Central Bank and its supervisory agency for the banking and financial system, was established in 1973 and ever since it has furthered the government's economic diversification programme by developing Bahrain as an international financial centre. In the mid 1970s, the BMA invited several major international financial institutions to establish a presence in Bahrain as a base for local and regional business activities.

Many financial institutions accepted the challenge, given the competitive advantages and facilities available in Bahrain. These include a convenient location midway between East and West time zones and the absence of corporate and personal taxation. Moreover, Bahrain has provided over the past 30 years an environment of political and economic stability as well as a pool of a highly skilled and qualified local work force.

The competitive operating environment in characterised by several factors including free convertibility of the Bahraini dinar and the absence of any restrictions on foreign exchange transactions or on capital transfers. The skills of Bahrains local and foreign banking staff are honed not only by experience on the job but through the numerous and frequently updated banking, financial and business courses offered locally by the highly reputable Bahrain Institute of Banking and Finance.

Several different kinds of banks are active in Bahrain. The commercial banks include locally owned and operated banks as well as branches of well-known foreign banks. At mid 2001, the consolidated assets and liabilities of the commercial banks amounted to US$10 billion.

In addition there are many local investment banks such as Investcorp, while others are locally incorporated representative offices of major foreign financial institutions.

The commercial and investment banking activity also includes a growing number of Islamic banking institutions. Bahrain has established a reputation as the leading centre of Islamic finance. Bahrain has the highest concentration of Islamic financial institutions among those countries which offer both conventional and Islamic banking. There are nearly 20 Islamic banks located in Manama, including names such as Albaraka Islamic Bank, Bahrain Islamic Bank, Gulf Finance House, First Islamic Investment Bank and others.

Many offshore banks also operate from Bahrain, led by Arab Banking Corporation and Gulf International Bank. The leading offshore banks have strong international reputations both in European, Japan and North American money centres as well as the developing world. Offshore banking units consolidated assets and liabilities amounted to $85.7 billion at the end of June 2001.

There are also several specialised banks including Bahrain Development Bank and The Housing Bank.

The overall size of Bahrain-based financial institutions has grown substantially during the post-Gulf War period, 1991-2001, when the consolidated balance sheet of the commercial banks increased by over 5.5 per cent annually on average, and that of the offshore banking units by 5 per cent.

Manamas banking institutions have proved highly resilient in overcoming the various regional and global challenges that have emerged during the three decades since Bahrain opened its doors as an international financial centre. No doubt they will continue to surmount the new challenges facing world banking today.

SUCCESS STORIES

" Abdulnabi Al Sho'ala

" Fahmi bin Ali Al Jowder

" Johnny Young

" Engin Turker

" Farouk Almoayyed

" Karlheinz Aumann

" Mohammed Buzizi

" Mohammed Dadabhai

" Ebrahim Al Dossary

" Haji Hassan

" Faisal Jawad

" Khalid Kanoo

" Saleh Al Kowary

" Iqbal Mamdani

" Akram Miknas

" Abdul Rahman Morshed

" Khamis Al Muqla

" Mustafa Al Sayed

" Jamil Wafa

" Khalid Al Zayani

Bahrain is gateway to

huge Mideast market

Centre of Gulf

banking universe

From 1984 until his retirement in March 2000, Paul Papadopoulos was chief economist of Arab Banking Corporation (BSC), one of Bahrains leading offshore banks. He is now managing director of Politicon Consultants, in Athens, Greece.